Menu

Landlord Income Tax Calculator

UK based landlords are required to notify HMRC if they are letting a property or part of their property. The Landlord Income Tax Calculator is designed for individuals who rent out a property as an additional/sole income (not as a seperate business). If you are renting properties as a business you should use a traditional accountant or online business accounting solution and pay yourself as an employee of the company.

| Total Annual Expenses from Properties (b) |

|---|

| Total Profit from Properties (c where c = a - b) |

| Your Gross Taxable Income (e where e = c + d) |

If you found this calculator useful, please leave a rating.

Please provide a rating, it takes seconds and helps us to keep this resource free for all to use

How to Use the Landlord Income Tax Calculator

The Landlord Income Tax Calculator is designed to be intuitive to use, it"s all about making income tax easy to calculate and understand. The calculator allows you to apply expenses to calculate the total expenses you cover as a landlord.

- Enter the Total Annual Income from Properties.

- Enter each of the expenses generated by your property for the year. See below guide for information on Legitimate Property Expenses for Landlords

- The Landlord Tax Calculator will calculate the Total Annual Expenses from Properties for you and calculate the Total Profit from Properties

- Enter Your Gross Income from PAYE employment, and other income.

- The Landlord Tax Calculator will calculate Your Gross Taxable Income and provide a link to the PAYE and tax payments calculation for your gross income to allow you to assess income tax and national insurance payments associated with your gross income.

Landlord Guides and Tax Calculators

- What is a Buy-to-let Mortgage?

- How do buy to let mortgages work?

- Budgeting for a buy-to-let mortgage

- Who can get a buy-to-let mortgage?

- How much can I borrow on a buy-to-let mortgage?

- Understanding buy-to-let mortgages and tax

- Pros and Cons of buy-to-let mortgages

- How to compare mortgages

- How much will it cost to move?

- Stamp Duty Calculator

- Monthly Budget Calculator

- Mortgage Calculator

- "How much can I borrow?" Mortgage Calculator

- Cost of moving home calculator

- Mortgage Fees Calculator

- Remortgage Calculator

- Loan to Value Calculator

- Mortgage Comparison Calculator

What is a Landlord?

A Landlord is a man (in legal application, also a woman) who is the legal owner of land, a building, or accommodation which is rented or leased to an individual or business, who is called a tenant (also a lessee or renter).

How to Calculate Landlord Income Tax

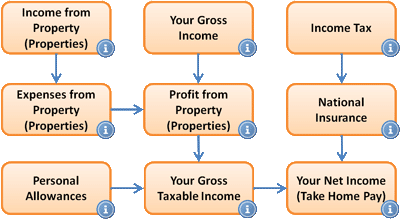

The process flow to the right defines the factors affecting your income tax calculation as a landlord. When calculating your income tax, it is easier to look at the process in reverse and understand how each of the elements are calculated. A common mistake that landlords make when submitting their tax return is to combine their own expenses and the expenses generated from the properties. This is incorrect, the correct tax process is to separate those expenses (treat the properties as a separate income revenue).

Net income = Gross Taxable Income - Income Tax Payable and National Insurance

Gross Taxable income = Gross Income - Personal Expenses

Gross Income = Profit from Properties + Personal Earnings

Profit from Properties = Income from Properties - Expenses from Properties

Legitimate Property Expenses for Landlords

As with the majority of taxes, it is your responsibility to ensure that you deduct any legitimate costs generated as part of income. If you don't deduct legitimate expenses, you will pay extra tax. Not claiming expenses is basically burning your hard earned cash.

The following expenses are legitimate expenses which occur as part of owning, maintaining and leasing/renting a property:

Accountant expenses

Only accounting expenses incurred in preparing rental business accounts, not accounting expenses incurred for preparing personal tax returns

Legal and Professional fees

Any legal fees incurred in the day to day management of your rental property. Including:

- The cost of preparing leases and inventories

- Collecting rent

- Preparing your tax return for the property (properties)

- Letting agent charges

Advertising costs of attracting new tenants

Including agency advertising costs, using a website like Rightmove, newspapers and so forth.

Charge for inventories

Most rental agencies will prepare an inventory for you for a fee which is a legitimate landlord expense.

Cleaning

Corrective and periodic (e.g. having carpets deep cleaned).

Costs of rent collection

Typically encompassed in Rental Agency fees though you may incur vehicle and fuel expenses if collecting in person (be careful, check with your accountant for advice pertinent to your particular situation).

Council Tax while the property is vacant and available for letting.

Typically, you will be afforded up to 6 months Council tax free though this has started to vary between regions with new legislation potentially ending this expense.

Note that a Council Tax exemption is typically facilitated through your local council and not reclaimed as an expense during annual income calculation.

Gardening

Corrective and periodic garden maintenance.

Ground rent

Insurances

- Insurance against loss of rents

- Insurance claim fees

- Insurance on buildings and contents

Mortgage interest charges

As such you can deduct any funds used to pay the mortgage interest charged by your lender. The capital repayment element of your mortgage is not deductible (further conditions apply).

UPDATE: The tax law affecting Mortgage Interest relief has changed, if you are a landlord with a mortgage you need to read this guide and calculator, your income is going to change significantly!

Interest paid on loans to build or improve premises

Conditions apply - we recommend you consult your accountant for valid and appropriate expense offset.