Menu

What is Provincial Tax?

In Canada, every individual needs to pay provincial or territorial income tax in addition to the federal income tax. The laws and policies for these taxes are developed by the provincial governments.

Provincial Tax in detail

The federal government collects the provincial tax through CRA for all provinces. So, the taxpayer makes one combined payment. The federal government then sends the received amount to the provincial government. The exception to this rule is Quebec, which has an independent tax system.

Provincial Tax rates

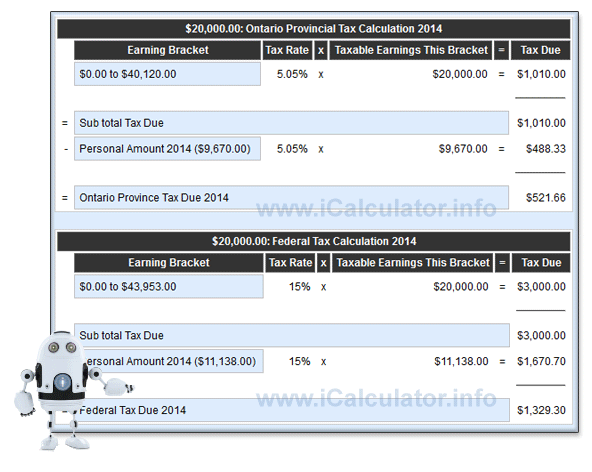

Each province has its own number of tax slabs and rates. For example, British Columbia has six tax slabs ranging from 5.06% on the first $37,606 of income to 16.8% for income above $150,000. The provinces of New Brunswick, Northwest Territories, Nunavut, Ontario, and Yukon have four tax slabs. Manitoba and Saskatchewan have three tax slabs. A notable exception is Alberta with a flat rate of 10% of taxable income, irrespective of income. Based on the province, the provincial tax rate can be in the range of 5.05% to 17.4%. So if you are earning $20,000 in Ontario, you will have to pay federal tax at 15% and Ontario tax at 5.05% of $20,000.

Provincial Tax Credits

Similar to federal taxes, taxpayers are eligible for tax credits on provincial taxes. Almost all provinces offer standard credits such as basic personal amount. Also available are other credits, which are similar to federal credits. These include age amount, disability amount, caregiver amount as well as credits on pension income and contributions to CPP or EI.

The amounts of these credits differ from federal amounts. For instance, the basic personal amount from the federal government is $11,138. While the personal amount is $9,869 in British Columbia, $9670 in Ontario, $9,134 in Alberta, etc. So, a resident of British Columbia earning up to $9,670 does not have to pay either provincial or federal tax. On an income between $9,670 and $11,138, the taxpayer will have to pay only provincial tax. On any income above $11,138, there is a credit available, which is a percentage of the lowest tax rate in both these taxes.

Let's take an example of a resident of British Columbia earning $15,000. This taxpayer will get a federal tax credit of $1,670 or 15% of $11,138 (15% is the minimum tax rate of the federal government). On the provincial front, this person will get a tax credit of around $499 or 5.06% of $9,670 (5.06% is the lowest tax rate charged by the provincial government of British Columbia.) So from the combined tax liability, there will be a deduction of $2169.

![British Columbia Tax Calculator: example $30,000 annual salary [Opens in a new window] British Columbia Tax Calculator: example $30,000 annual salary](https://www.icalculator.com/images/ca/british-columbia-tax-calculator.png)

Apart from the standard credits, there are also credits specific to each state. Some of these include foreign tax credit, political contribution credit, tax on split income, logging tax credit, mineral exploration tax credit, etc.

How does Provincial Tax affect your tax?

Provincial taxes lead to additional taxation apart from the federal taxes. You can calculate the provincial tax due on your income using the tax calculator (please select the appropriate province).

Canadian Tax and Finance Guides

- What does Deduction For Copyright Income mean?

- What does Net Pay mean?

- What does Canada Pension Plan mean?

- What does Employment Insurance Premiums mean?

- What does Provincial Tax mean?

- What does Federal Tax mean?

- What does Lifetime Capital Gains Exemption mean?

- What does Capital Asset mean?

- What does Capital Investments mean?

- What does Child Care Expenses mean?

- What does Union Dues mean?

- What does Alimony mean?

- What does Registered Retirement Savings Plan mean?

- What does Ineligible Dividends mean?

- What does Eligible Dividends mean?

- What does Capital Gains mean?

- What does Interest mean?

- What does Gross Pay mean?