Menu

P60 Tax Return Procedure and P60 Form Guide by iCalculator™

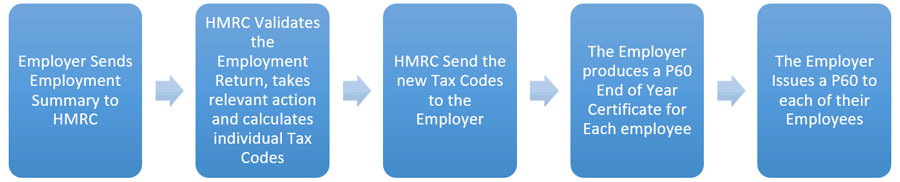

In this P60 Guide we review the steps involved in the end of year return, the aim being to provide an understanding of the end of year payroll process and steps that occur to allow the creation of a P60 End of Year Certificate

At the end of each tax year every employer must send an employment summary to HMRC (Her Majesties Revenue and Customs).

Please provide a rating, it takes seconds and helps us to keep this resource free for all to use

The employment summary must include:

- The full name(s) of all employees employed at the end of the tax year. Employees who left the company before the end of the tax year are not included on this return as they will either be recorded on their new employers return or, if they have not taken a new job, employment details will be held by HMRC based on the P45 issued when the employee left the company.

- The amount earned during the tax year (Gross Salary)

- The amount deducted for National Insurance Contributions (NIC)

- The Amount deducted for Pay As You Earn (PAYE)

The employment summary is used by HMRC to record and audit the taxable income for each employee. HMRC can then review the various elements and identify whether:

- The PAYE and NIC contributions are correct and issue a standard tax code

- The employee has paid too much PAYE/NIC and issue a tax refund and/or adjust the tax code for the following tax year to reflect the overpayment.

- The Employee has not paid enough PAYE/NIC and send a letter requesting payment and/or adjust the employees tax code to recoup the difference during the next tax year.

For those employees who have straight forward income and deductions, HMRC will aim to provide most adjustments directly through the manipulation of the tax code. The aim being to provide a standard pay calculation for the employee and avoid any large over/under payments.

How to use P60 to get a Tax Rebate

Did you know your P60 can help you get a tax rebate? Your P60 is an important document and you shouldn't just stuff it in a drawer! Your employer should give you your P60 after the end of the tax year if you were working for them on April 5 and the deadline for employers to give you this document is May 31.

So what exactly is a P60?

Your P60 is a document that states your earnings and summaries any deductions from your income such as tax and National Insurance Contributions. The information on this document can help our tax team determine if you have overpaid tax! We can check things like your tax code and any other expenses you may be able to claim to maximize.

We all know it's a drag to pay taxes especially when you look at your pay slip and ask yourself where has all that money gone?! Luckily, if you're a PAYE employee in the UK there are a number of items you may be able to use to claim tax relief. How much you can claim will depend on the rate of tax you paid.

As a UK PAYE employee, there are a number of items that you may be able to use to claim tax relief!

Flat Rate Deductions

H M Revenue and Customs (HMRC) have a list of occupations that qualify for tax relief at set amounts. The list covers different types of industries and roles including pilots, police, agricultural workers and the armed forces. Even if your particular occupation isn't on the list, you may still be able to claim the standard annual allowance.

You won't need to keep records of what you've paid for if you claim a flat rate deduction. These tools are designed to help you check it you're due any relief in the form of a flat rate deduction when you apply for a tax rebate!

Expenses you can claim

The most important rule to remember for an expense to be allowable is that it must be incurred wholly, exclusively and necessarily in the performance of the duties of the employment.

Other rules include:

- You can only claim for items used for work and not in your private life

- You must have paid for the expenses yourself

- You can't claim on items where your employer has provided an alternative

- You must have paid tax in the year you paid for the expense

- You must not have been reimbursed for the expense OR if your employer reimbursed the expense but you were taxed on the reimbursed amount it should be included in your taxable earnings or reported on a Form P11D, so you can claim relief at the end of the tax year

- You should keep all records of expenses

- if you need to travel for work then you may be able to claim tax relief on the cost of overnight expenses and food.

Examples include: Public transport, Hotel accommodation, Food and drink, Tolls and parking, Business phone calls Business mileage and much more.

Next: 2024/25 Payslip and Payroll Software

Previous: 2024 P60 Employer Checklist

P60 2024: Guides and Tools

iCalculator's P60 Guides and P60 Calculators include detailed information and guidance to help you understand your P60, identify key parts of the P60, explain how your P60 is calculated and what information you need to know and understand about a P60 as an employee and employer. Our aim with the P60 guides is to provide insight into the correct completion of a P60, whether it be an audit as an employer to ensure your end of year certificates are calculating correctly or as an employee to check that you have paid the right amount of income tax and, if not, how to claim any overpaid tax back.

- What is a P60?

- P60 Form

- P60 Tax Return Process

- P60 Explained

- P60 Checklist

- PAYE Forms Explained: Know more about P45, P46, P60 Today

- 60 Second P60 Guide

- When should you recieve a P45 and P60 in 2024?

- P60 Healthcheck

- 10 Tax Saving Tips

- 2024 P60 Employer Checklist

- 2024/25 Payslip and Payroll Software

- How to use P60 to get a Tax Rebate

- Step by Step instructions to File Tax Return Online in the UK

- 2024 Guide to tax forms P45, P60 and P11D

- Get a Tax Refund when you leave the UK: PAYE, P45, P85 explained