Menu

2024 P60 Healthcheck

The P60 Healthcheck examines the P60 (Your End of Year Certificate), explains the errors you should look for to reclaim tax, how the P60 process works and what to do if you find an error on your P60 for the 2023/24 tax year.

Had your P60 for 2023/2024 Tax Year? Check your Tax Bill!

We suggest you also complete a Salary calculation to compare against your P60, review our tax saving tips and discover more about Self Assessment. You may also be interesting in understanding how income tax works.

Please provide a rating, it takes seconds and helps us to keep this resource free for all to use

P60 Review: Introduction

It is your responsibility as an employee or pensioner to check your P60 and claim back any over paid tax! The sad truth is that most people don't take the time to check their P60 and often end up paying the wrong PAYE Tax.

Employees and pensioners should always check the tax taken from them under Pay As You Earn (PAYE). Most employees should now have received their P60 form their employer.

What is a P60?

A P60 is a Tax Certificate issued at the end of the financial Year, the P60 is the End of Year Certificate. In the UK and Ireland, a P60 is a statement issued, typically via your employer, to taxpayers at the end of a tax year. It is essential that you keep your P60's as they form a vital part of the proof that tax has been paid.

More importantly, they allow you to review how much Tax you have paid and decide if you have paid too much tax.

Your P60 will contain specific information about:

- PAYE: The total Pay As You Earn (PAYE) tax you have paid for the year. Suggested Reading: How to legally pay less National Insurance Contributions

- NI: The total National Insurance Contributions (NIC) you have paid for the year.

Important!!! If your company uses a Salary Sacrifice scheme ensure that your deductions matched your reduced salary rate, you can check using the salary calculator (ensure you use the correct Tax Year).

How Do HMRC Calculate my Tax?

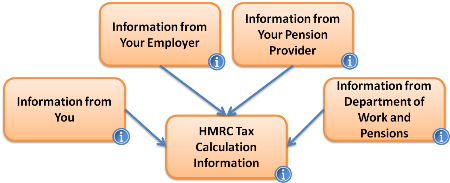

HMRC base their tax coding and the amount of PAYE due based on information they receive from the following sources:

- You: Self Assessment Tax Return

- Your Employer: Information about your earnings, the hours you work, salary sacrifice schemes, bonus and benefits etc.

- Your Pension Provider: Total of contributions, how regularly you pay your pension, Tax deductions and additions made.

- Department for Work and Pensions (DWP) Information on any state benefits that you have paid.

All the above have the ability to influence your Tax payments and if one element is wrong it can easily mean you pay too much or too little tax. Identifying you have a tax refund is a fantastic feeling but, in reverse, identifying that you have underpaid tax can be a nightmare but only if you don't deal with it!! In some circumstances, HMRC will write-off underpaid tax, especially if you can prove the underpayment was due to HMRC's fault and repayment will cause you financial difficulty.

Tax problems often occur when individuals don't complete their self-assessment tax returns, especially if you have more than one job, have earnings on top of your salary etc. HM Revenue & Customs (HMRC) might not have all the information it needs or conflicting information and, as a consequence, may not get your tax right.

When will I receive my P60?

You will receive your P60 after the Tax Year has finished on 5 April. After the 5th April HMRC will close off your earnings calculations and calculate how much Tax you should have paid during the financial year.

Once complete:

- If you paid the right tax: That's it! you here nothing from the HMRC

- If you paid too much tax: You will see the letter 'R' in your P60 indicating that a Refund is due. You should then receive a letter from HMRC confirming the refund amount and a cheque for the full amount of the Tax Refund.

- If you did not pay enough tax: Situations vary but typically you will receive a bill for the unpaid tax if the amount due is over £50. Alternatively HMRC may adjust your personal tax allowance to recover the debt.

What should I look for on My P60?

The first thing is to check the figures. You may want to put your annual salary into the salary calculator and see how the breakdown of PAYE and National Insurance Contributions compares.

Salaries and allowances differ between individuals so it is important that you check that all your allowances have been paid, for example:

- Multiple Jobs: Ensure that the earnings from each of your jobs has been consolidated. i.e. £6k + £17k = £23k --- £23k is the figure you should be taxed on.

- Self Audit: Check your Salary Slips, review banks statements, does everything tally?

- Pension Contributions: Pension contributions reduce your tax liability so you pay less tax, is this accounted for?

- Gift Aid Donations: Gift aid donations reduce your tax liability so you pay less tax, is this accounted for?

- Business Expenses: This includes mileage allowance for using your own vehicle for business travel, uniform or work clothes allowances for certain trades and other business associated costs. Ask your employer if you're not sure.

- Personal Tax Allowances: Have all of your personal tax allowances been applied? These include disability and age related allowances

What should I do if I paid the wrong amount of Tax?

What you should not do is ignore it! Unfortunately too many people ignore errors on their P60 and this can lead to bigger problems later. HMRC's accounting software is complex but increasingly robust and capable of identifies historical tax discrepancies with minimal human interaction. This means that it is very likely they will catch up with you.

So, in answer to the question, Act Now! The sooner you address the tax problem the better. It is worth noting that HMRC have a positive and supporting approach these days and work with those who report errors early.

Those who don't report irregularities tend to be viewed less favourably.

If you are unsure of anything on your P60 or you think the calculation is wrong, contact HMRC.

- Write to HMRC using the last correspondence address (your local tax office) or to the generic HMRC address: HM Revenue & Customs, Pay As You Earn, PO Box 1970, Liverpool, L75 1WX

- Telephone 0845 300 0627. Opening hours

- Monday to Friday: 08:00 - 20:00

- Saturday: 08:00 am - 16.00

- The text phone for those with hearing or speech impairment is 0845 302 1408.

Next: 2024 Tax Saving Tips

Previous: P60 Checklist 2024

P60 2024: Guides and Tools

iCalculator's P60 Guides and P60 Calculators include detailed information and guidance to help you understand your P60, identify key parts of the P60, explain how your P60 is calculated and what information you need to know and understand about a P60 as an employee and employer. Our aim with the P60 guides is to provide insight into the correct completion of a P60, whether it be an audit as an employer to ensure your end of year certificates are calculating correctly or as an employee to check that you have paid the right amount of income tax and, if not, how to claim any overpaid tax back.

- What is a P60?

- P60 Form

- P60 Tax Return Process

- P60 Explained

- P60 Checklist

- PAYE Forms Explained: Know more about P45, P46, P60 Today

- 60 Second P60 Guide

- When should you recieve a P45 and P60 in 2024?

- P60 Healthcheck

- 10 Tax Saving Tips

- 2024 P60 Employer Checklist

- 2024/25 Payslip and Payroll Software

- How to use P60 to get a Tax Rebate

- Step by Step instructions to File Tax Return Online in the UK

- 2024 Guide to tax forms P45, P60 and P11D

- Get a Tax Refund when you leave the UK: PAYE, P45, P85 explained